In Malaysia the corporate tax rate is now capped at 25. Manufacturing information technology services energy conservation environmental protection or biotechnology are among the industries that have tax incentives available for investors.

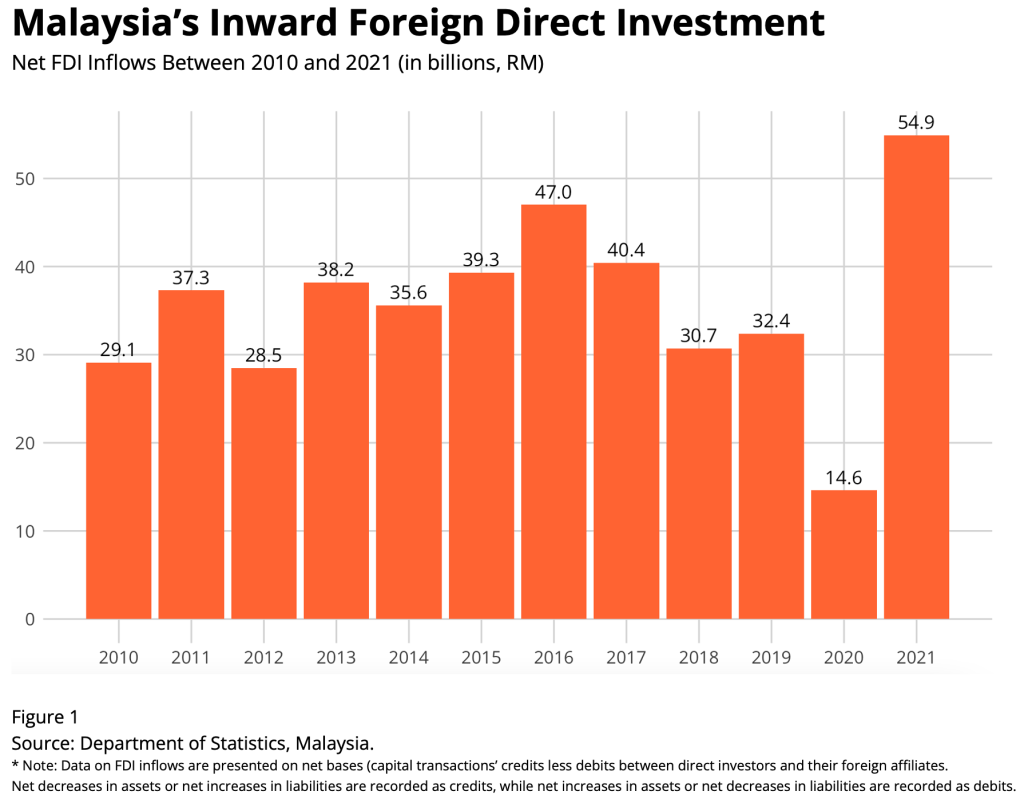

Sustaining Malaysia S Fdi Rebound Promotion Is Good Facilitation Better Fulcrum

FHTP the Government has put in initiatives for a more effective tax reliefs and incentives.

. Tax Incentives Malaysia offers an extensive variety of expense motivators for the advancement of interests in chosen industry divisions which incorporate the customary assembling and rural parts and also different areas for example those engaged with Islamic budgetary administrations ICT instruction tourism social insurance and in addition innovative. In Malaysia the corporate tax rate is now capped at 25. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

5 BOG have been reviewed and amended to adhere to the minimum standards under Action 5 of the Organization for Economic Cooperation and Development OECDs Base Erosion and Profit Shifting BEPS Project see Tax Alert No. Extension of incentives for new four- and five-star hotels. Many tax incentives simply remove part or of the burden of the tax from business transactions.

The salient features of these incentives are discussed below. Many tax incentives simply remove part or of the burden of the tax from business transactions. By law individuals and corporations are required to file an income tax return every year to determine whether they owe any taxes or are eligible for a tax refund which you can.

Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10. Nevertheless a company eligible for a certain tax incentive might only pay an average effective tax rate of 75 with only 30 of the companys profit being subjected to tax. Pioneer Status PS The standard PS incentive is a partial exemption from the payment of income tax for a period of 5 years up to 70.

Malaysia joined the OECD. Tax Incentive for Bond and Sukuk In Malaysia. Nevertheless a company eligible for a certain tax incentive might only pay an average effective tax rate of 75 with.

A few business incentives were introduced including an extension to the Accelerated Capital Allowances incentive for automation equipment to 2020 a new allowance of up to 200 percent for the manufacturing sector and a new Capital Allowance Incentive for information and communications technology ICT firms from 2018-2020. As highlighted in earlier tax alerts the financial incentives under the Multimedia Super Corridor MSC Malaysia Bill of Guarantee No. In December 2018 the Government has gazetted new legislation orders exemption orders and amendments to the legislation Orders in.

Tax Incentives Income Exempt From Tax Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty. This is demonstrated through. Malaysia has enacted a number of tax incentives to encourage particular forms of economic activity.

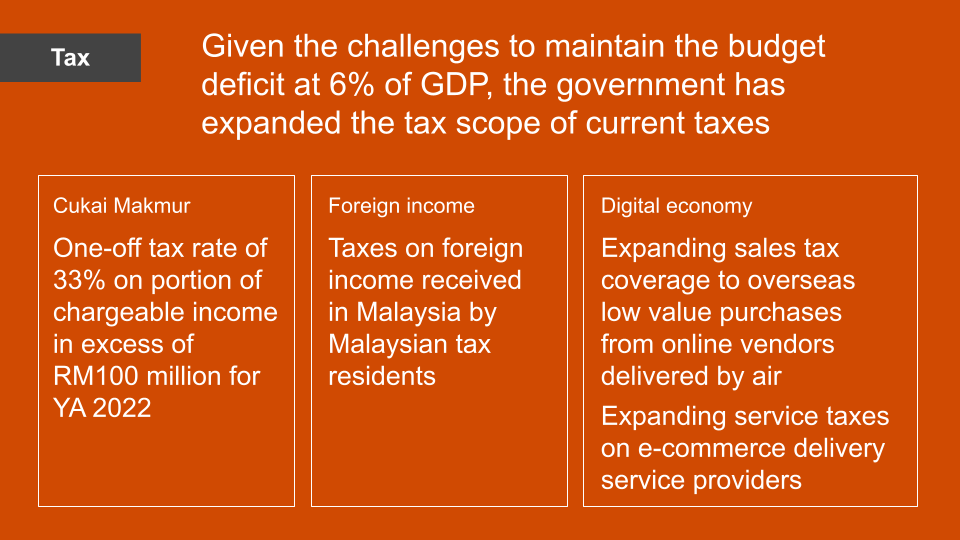

On 6 July 2018 the Malaysia Digital Economy Corporation MDEC the government agency overseeing the Multimedia Super Corridor MSC Malaysia initiative to promote the growth of local technology companies and attract investments from multinationals issued an announcement that the tax incentives under the regime will be amended to reflect the. Malaysias prime minister presented the 2018 Budget proposals on 27 October 2017 and announced a slight reduction in individual income tax rates and partial exemption of rental income. 1 There is also a revised treatment of real property gain.

Malaysia has tax incentives that range from exemptions to allowances and even tax deductions. Malaysia Tax 11 July 2018 Tax Espresso Special Alert Changes in MSC Malaysia Tax Incentive following Malaysias commitment in implementing international tax standards The Ministry of Finance has recently reiterated its commitment in adhering to the OECD taxation initiatives. To expand tourism the budget has extended the tax incentive for investment in four- and five-star hotels for a further two years while the tax incentive for tour operators.

The allowances are possible to be forward until they have fully utilized it. YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14. Currently this incentive is available for applications made to the Malaysian Investment Development Authority MIDA by April 30 2018.

Generally tax incentives are available for tax resident companies. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. Jan 29 2018.

With a person in Malaysia for 5 consecutive YAs. Malaysia government imposed an income tax on financial income generated by all entities within their jurisdiction. There are tax incentives for information and communication technology wherein the incurred costs in the development of an e-commerce website have a yearly deduction of 20 in a total of 5 years.

This is a good example of how the. Malaysia is also committed to align themselves to the global standards. Incentives for companies in Malaysia Investments in a number of industries in Malaysia are facilitated by the available tax incentives.

This report covers some of the important measures affecting individuals in Malaysias 2018 budget. 20182019 Malaysian Tax Booklet Personal Income Tax. 20182019 Malaysian Tax Booklet.

Tax Incentives 61 An approved individual may choose to be charged a flat tax rate of 15 on the chargeable income from employment as provided under Part XV of Schedule.

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

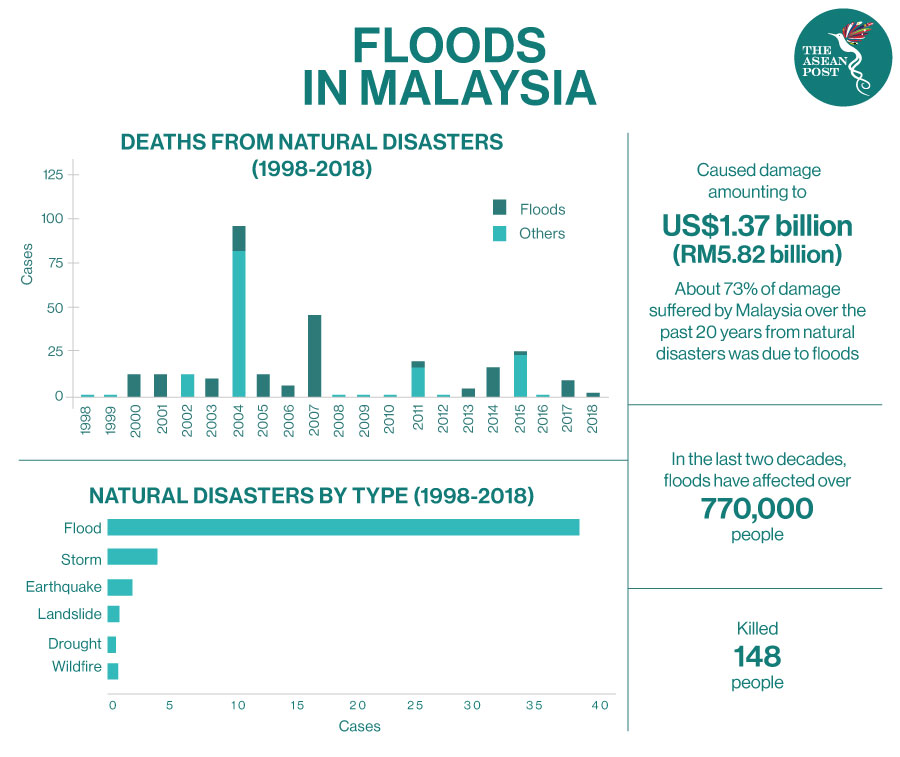

Extreme Weather Malaysia S Flood Woes To Worsen The Asean Post

Updated Guide On Donations And Gifts Tax Deductions

19 Initiatives That Ll Benefit The Youths Under Malaysia S Budget 2022 Social Good

Why It Matters In Paying Taxes Doing Business World Bank Group

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

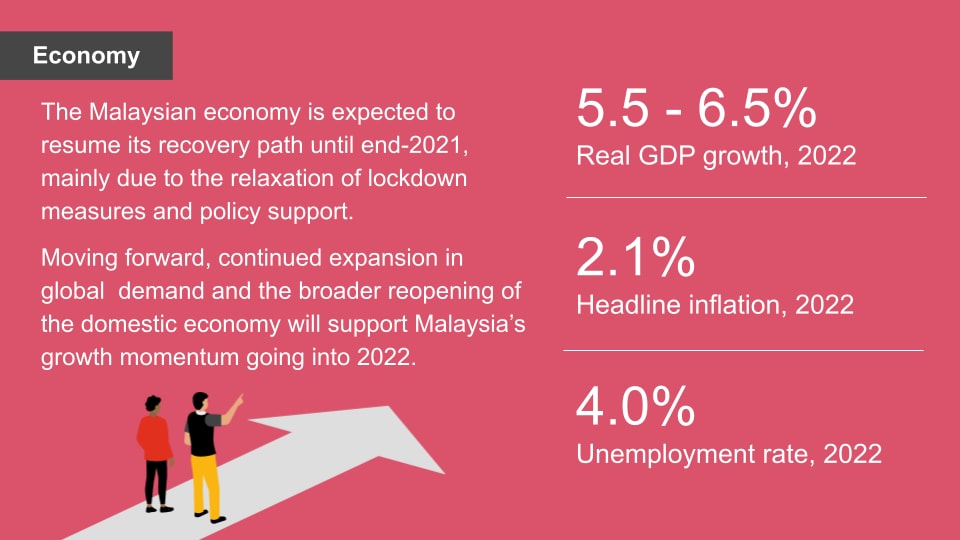

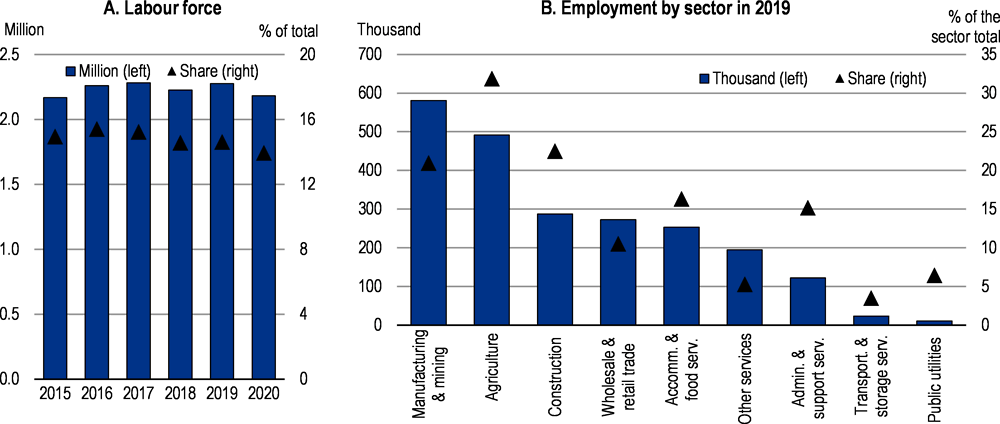

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

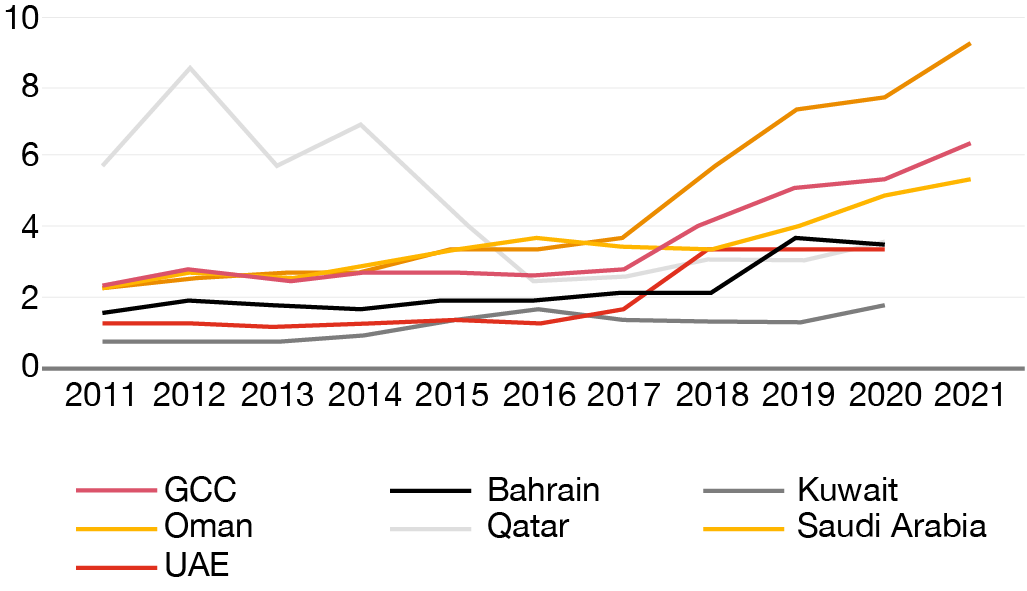

From No Tax To Low Tax As The Gcc Relies More On Tax Getting It Right Is Critical For Diversification Pwc Middle East Economy Watch

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

A Proposal For Carbon Price And Rebate Cpr In Malaysia Penang Institute

Malaysia S 2018 Budget Salient Features Asean Business News

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

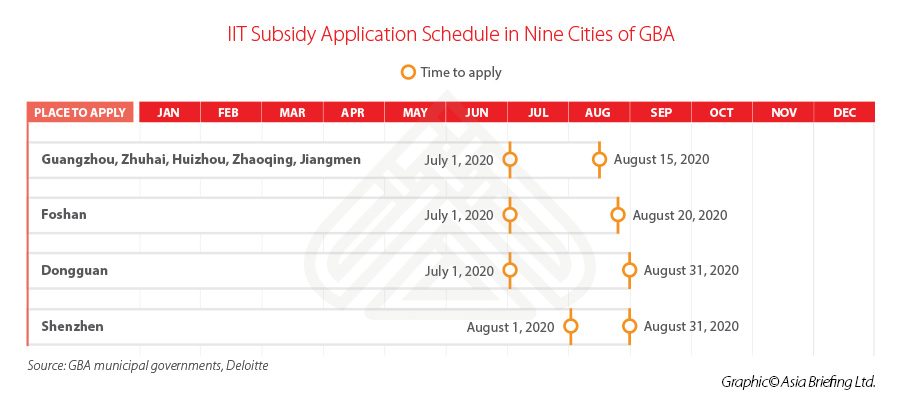

Applying For Individual Income Tax Subsidies In China S Greater Bay Area

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

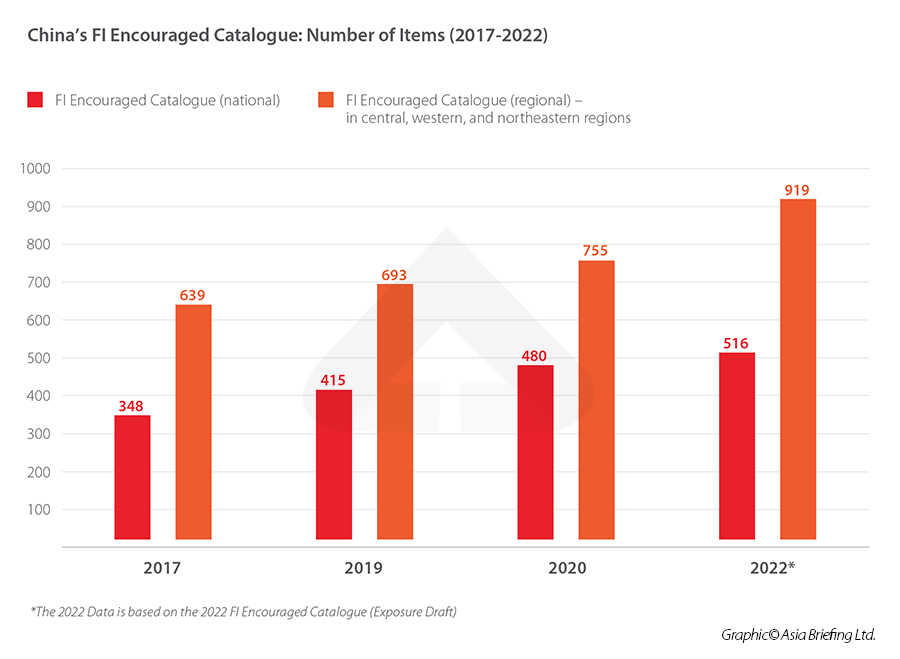

China S Draft 2022 Encouraged Catalogue Signals New Opportunities